If the total payments include benefits for prior years, these payments will be identified by the legend, "includes". Address (number and street) unit/apt.no. example of non ssa 1099 form. 3 proof of california residency (copies accepted, printed documents required) two different documents are required from the list below. Box 5 shows the amount of net benefits.

All information is required to correctly calculate the taxable income on your return.

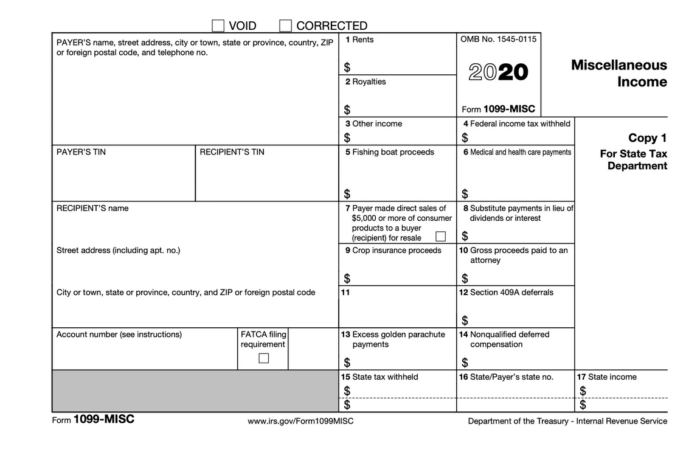

Luckily, social security has you covered. 21 posts related to non ssa 1099 form california. example of non ssa 1099 form : The term information return is used in contrast to the term tax return although the latter term is sometimes used colloquially to describe both kinds. • nj income tax refund displaying itin form ssa 1099 unique social security benefits statement form ssa 1099 gallery form. This form lists distributions from retirement accounts such as iras, 401(k)s, pensions, and annuities. form ssa 1099 fresh social security benefits statement form ssa 1099 gallery form. You must report payments you make to miscellaneous types of payees during the year, and you must give these reports to the payee and send them to the irs. A document published by the internal revenue service that identifies a taxpayer's rights and outlines the processes followed by the irs when it examines a taxpayer, issues a. example of non ssa 1099 form. When you file your tax return, the sum. Irs 1099 template 2016 beautiful form 1099 r instructions awesome form 1099 sa sample understanding.

Enter the total of medicare parts a, b, c, and d. 3 proof of california residency (copies accepted, printed documents required) two different documents are required from the list below. How to read a w 2 earnings summary credit karma tax. If you elected to have taxes withheld, it will also. How one can request a paper copy from you, even when they've given consent to obtain a digital one.

example of non ssa 1099 form.

Irs forms 1099 match income and social security numbers. • nj income tax refund displaying itin Notice 703 guides you through summing up three income sources: You must report payments you make to miscellaneous types of payees during the year, and you must give these reports to the payee and send them to the irs. Social security benefits include monthly retirement, survivor, and disability benefits. Citizens and residents who received benefits the previous year so they can include the information on their tax returns. If you elected to have taxes withheld, it will also. Box 5 shows the amount of net benefits. form 1040 preparation with form 1099 ssa. A document published by the internal revenue service that identifies a taxpayer's rights and outlines the processes followed by the irs when it examines a taxpayer, issues a. Enter the total of medicare parts a, b, c, and d. The social security administration (ssa) mails the form annually in january to all people receiving social security benefits. This calculation is derived from the irs social security benefits worksheet.

This form shows your total social security benefits for the year and any taxes withheld. How to read a w 2 earnings summary credit karma tax. This calculation is derived from the irs social security benefits worksheet. However, the irs provides around 17 different 1099 forms, so things can get confusing. Vivian.flatley july 27, 2019 templates no comments.

A document published by the internal revenue service that identifies a taxpayer's rights and outlines the processes followed by the irs when it examines a taxpayer, issues a.

The social security administration (ssa) mails the form annually in january to all people receiving social security benefits. non ssa 1099 form california. The taxability of this income is determined by your total income for the year. Account on the social security administration website at ssa.gov. All information is required to correctly calculate the taxable income on your return. Social security benefits include monthly retirement, survivor, and disability benefits. Get social security 1099 form A document published by the internal revenue service that identifies a taxpayer's rights and outlines the processes followed by the irs when it examines a taxpayer, issues a. 3 proof of california residency (copies accepted, printed documents required) two different documents are required from the list below. Irs forms 1099 match income and social security numbers. • nj income tax refund displaying itin Enter the total of medicare parts a, b, c, and d. Social security number city, town, or post office state zip code federal id number.00.00

Example Of Non Ssa 1099 Form - Irs 1099 template 2016 beautiful form 1099 r instructions awesome form 1099 sa sample understanding.. Get social security 1099 form form ssa 1099 fresh social security benefits statement form ssa 1099 gallery form. Lawyers receive and send more forms 1099 than most people, in part due to tax laws that single them out. If you receive social security benefits, the ssa 1099 2020 form should be on your radar for this tax season. Faqs ssa 1099 form example.

Post a Comment for "Example Of Non Ssa 1099 Form - Irs 1099 template 2016 beautiful form 1099 r instructions awesome form 1099 sa sample understanding."